Nearly four years after Canada rolled out its emergency pandemic benefit programs, some recipients are only now just finding out they were not eligible and must pay thousands of dollars back to the government.

“To be honest, I’m struggling,” Toronto resident Michael Madden told CTV News Toronto in an interview last week. “I have a lot of bills, and with the cost of living, it’s just really hard to manage.”

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

Madden is among the many Canadians who have been asked to pay back benefits that date back to the onset of the pandemic in March 2020.

Between March and October 2020, the federal government paid out nearly $211 billion in emergency benefits to 8.9 million Canadians. Almost $5 billion of that funding, however, was dispersed to ineligible applicants, an auditor general’s report later revealed.

For Madden, the confusion came when additional programs were introduced.

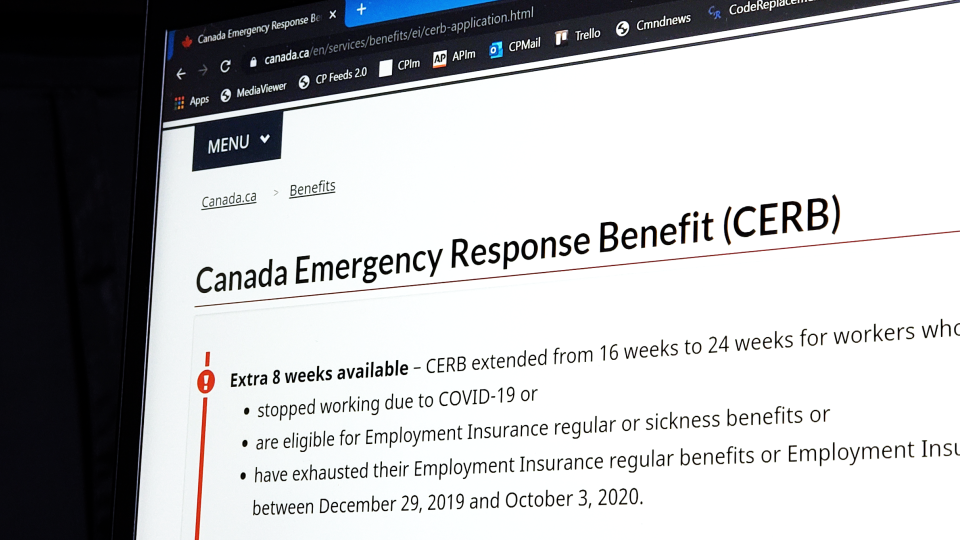

In late 2020, the CRA terminated the initial Canadian Emergency Response Benefit (CERB), always intended as a temporary aid, and instead introduced several more specified applications. What most Canadians knew as CERB became CRB, the Canadian Response Benefit – a program that was largely similar but allowed applicants to report more self-earned income.

At the time, Madden was working as a full-time administrative assistant, but the onset of the pandemic slashed his office’s customer base and in turn, his hours.

“I was able to apply for the full $14,000 from CERB,” Madden said. “But then when CRB rolled out I assumed I also qualified for that because they said it was for technology or electrical workers, so I applied.”

He was approved for $4,000 through CRB, a sum he is now being asked to pay back, though he doesn’t think he should have to.

“I think the government should take responsibility and say you know what, we made a mistake,” he said.

The Canadian Emergency Business Account (CEBA) was also made available in late 2020. Through CEBA, Canadian business owners could apply for up to $40,000 in non-amortized loans.

The CRA asked for those loans to be paid back in December 2023, with an extended deadline of Jan. 18, 2024. Any outstanding balances will “likely” be assigned to collections, it says on its website.

Theo Westpark, a commercial designer, has owned and operated her own business in North York since 1996, but with the pandemic, came a crash in clientele — the demand for renovation projects had plummeted and with it, her sales.

Westpark applied for CEBA and was granted the maximum $40,000 loan.

Now, three years later, she’s being asked to pay it back – but the pandemic and economy have left her with little room to make those payments.

“When they asked me to pay it back, I had about $6,000 saved – a far cry from the $40,000 needed,” Westparks said.

She went to the Royal Bank of Canada, where she said she’s been a customer for over 35 years, and asked for a loan.

“They refused,” she said.

In the interim, Westpark has had to shutter her physical office space and transition into working from home in order to reduce costs.

“There’s no two ways about it – I don’t think [the CRA is] doing anything, at this point, to offer an alternative solution,” she said.

“A lot of people and businesses will suffer because of this, and a lot of doors will close.”

READ MORE: ‘How could they allow this?’ Many Canadians frustrated with CERB experience

Toronto tax lawyer David Rotfleisch said he’s seeing, on average, about two to three people per week who have been asked to repay their emergency benefits.

“I wouldn’t say they’re all necessarily surprised,” Rotfleisch said.

Most people are finding out they owe the government as part of an audit process, Rotfleisch said. The CRA likely does not devote a great number of auditors to emergency benefit repayment, as the totals are “relatively low.”

“That means it will take time for a CRA to audit all recipients. I suspect that is their goal,” he said.

Among the individuals Rotfleisch has dealt with, there is variety when it comes to why they’re being asked to repay.

“The rules [to apply] were relatively complex,” he explained. “In many cases, people applied and thought they qualified but did not. In other cases, CRA audit results are unreasonable or wrong. And also there are cases where taxpayers applied knowing they probably did not qualify.”

If you’ve been asked to repay emergency benefits, Rotfleisch said the first thing to do is determine whether or not the CRA’s denial is correct.

If you have reason to believe the Notice of Redetermination is wrong, you can challenge it. You will need your CRA account information and any relevant documentation, including your proof of eligibility, on hand.

If the notice is accurate, payments can be made online, by mail, or in person. The CRA is also recouping payments by garnishing individuals’ tax returns — a process that takes place automatically and has caught some taxpayers, like Madden, off-guard.

“I would actually ask the government to reconsider doing that and instead work with people to make payment arrangements,” Madden said.

“People are counting on and need that money.”